Add Backs in Depreciation in Business Valuations

One of the most common mistakes that people make is to add back depreciation in business valuations on the basis that it is a non-cash item.

Whilst this is correct in discounted cash flow valuations, because depreciation is added back and deduction is made for expected capital expenditure.

Depreciation is an allocation of a fixed asset over its useful life. Thus a $100,000 piece of equipment that has a useful life of 10 years is depreciated over 10 years at $10,000 per year.

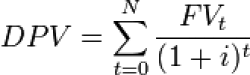

In a discounted cash flow, we look at the cash flows of a business over time as opposed to profits.

As a simple example:

|

Year 1 |

Year 2 |

Year 3 |

|

| Profits |

200 |

200 |

200 |

| Add Depreciation |

10 |

10 |

10 |

| Less Capital Expenditure |

- |

-200 |

- |

| Net Cash Flows |

210 |

10 |

210

|

The adding back of depreciation in future maintainable earnings valuations is incorrect in that it represents a fundamental misunderstanding of the theoretical background of the future maintainable earnings value

Future Maintainable Earnings methodology is a simplified version of the discounted cash flow methodology. Mathematically, the value under either model can be proven to be the same if the following assumptions are made:

a) Profits = cash flow

b) Depreciation = expected capital expenditure

c) Growth is constant or nil

To put it another way, the equipment will need to be replaced at some time and the value of the business needs to take that into account. If the replacement cost is significant, then the FME methodology should not be used, thus the discounted cast flow methodology should be used.