Amazon Forced to Pay your Tax

Budget measures just announced by the UK Government will make Amazon liable for any VAT evaded by overseas sellers on the Amazon.co.uk marketplace.

To quote the Budget Papers:

“HMRC will be able to require non-compliant overseas traders to appoint a tax representative in the UK, and will be able to inform online marketplaces of the traders who have not complied. If traders continue to evade VAT and no action is taken to prevent the fraud, then online marketplaces can be made liable for the VAT.”

“The government will also introduce a due diligence scheme for the fulfilment houses where overseas traders store their goods in the UK. This will make it harder for VAT evading firms to trade.”

Amazon is not going to like this

Estimates of the VAT evaded by overseas online sellers is £500 million per year.

So expect to see some drastic changes to Amazon.co.uk shortly.

Amazon has a few options.

- They could retain 20% of your payments until you can prove that you have complied with VAT regulations and paid your VAT. This is unlikely as it is an administrative nightmare.

- They could:

- ban you from selling on the Amazon.co.uk; and

- withhold any payments due to you

until you can prove that you have registered for VAT, paid any outstanding VAT and have a registered VAT agent.

This is likely given Amazon’s past policy for patent, trademark, and quality disputes.

Don’t let Amazon close your account

Blocking your account will be a disaster for you – no sales, no cash-flow and stock sitting in warehouses that you cannot sell. Plus, there will be a long queue of people trying to get their account unblocked.

These budget measures are a great opportunity for you because while everyone else is trying to get their account unblocked (and some giving up) – you can be taking their sales and getting higher on the rankings with less competition.

You can double your sales

Our clients are already getting fantastic results in Amazon UK and they are already making a foothold in the massive European market. Europe has a population of 508 million compared to 320 million in the USA and Amazon is only just getting started in Europe.

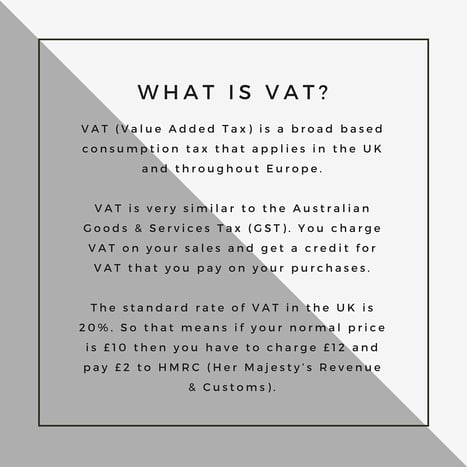

You Must Register for VAT

Many overseas sellers make the mistake in assuming that the VAT threshold of £83,000 in turnover applies to them.

As an overseas based business selling over the internet, there is no threshold. You are required to be registered and pay VAT quarterly from £1 in sales. The threshold only applies to UK based sellers.

So every overseas based seller selling on Amazon.co.uk is required to be registered for VAT and lodge quarterly VAT returns.

You don’t have to pay 20% VAT

There are a number of concessions depending on what products you sell and the size of your business. You could be charging 7.5% (legally of course) whilst all your competitors are paying 20%.

As part of our VAT service, we can check whether you qualify and which scheme or concession is right for you – it is different for everyone.

We are Registered VAT Agents

As Registered VAT Agents approved by HMRC, we can:

- Register you for VAT – as part our pre-registration checks, we ensure that you are in the right scheme for you so you pay the least amount of VAT.

- Be your Registered VAT Agent – this means that HMRC will talk to us first and we can usually sort out the issue very quickly. Plus we get express contact lines so that we don’t have to wait in the telephone queue.

- We speak Tax – we know the terminology and the law so we can get to the heart of any problem quickly.

- Lodge your Quarterly VAT Returns – we can calculate the VAT that you owe, ensuring that you don’t pay too much.

Get ahead of your competition and don’t wait for Amazon to close your account before action.

Contact us or call on 02 9411 5422 to arrange a no-obligation chat about how we can register your business for VAT.

P.s – We know your business – call us and let us prove it to you.