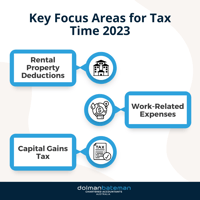

The Australian Taxation Office (ATO) has identified three key focus areas for Tax Time 2023: rental...

ATO targets Teachers: Work related Expenses

The ATO has just released statistics on work related expense claims during last year.

The ATO has just released statistics on work related expense claims during last year.

Approximately 7.3 million taxpayers claimed work related expenses, and on average $2,008 was claimed for items such as car, travel, uniform and self education.

The ATO monitors these types of claims and inparticular certain occupations where average expenses are high, or there is an significant increase in the number of taxpayers making claims.

This year the ATO will be targeting the following occupations:

- Teachers

- Engineers

- Mechanics

The most common mistakes made by taxpayers in these occupations include:

- insufficient documentation and receupts to support claim

- incorrectly including travel from home to work in motor vehicle claim

- incorrectly claiming home internet, telephone and home office usage

It is important if you are in one of these occupations that you get your work related expense claim correct. This ensures that you have receipts and are able to document all your claims. Here at Dolman Bateman we can ensure that you make the correct claim for work related expenses.

This article has been prepared for the purposes of general information and guidance only. It should not be used for specific advice or used for formulating decisions under any circumstances. If you would like specific advice about your own personal circumstances please contact our office.