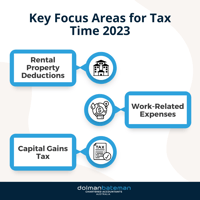

The Australian Taxation Office (ATO) has identified three key focus areas for Tax Time 2023: rental...

Behind the Numbers: Most taxpayers in the dark about their return result

.png)

Filing taxes is an annual ritual that millions of people around the world go through, yet it remains one of the most complex and confusing tasks for the majority of taxpayers. Despite the advancements in technology and accessibility of information, many individuals still find themselves in the dark when it comes to understanding their tax return results.

Recent survey findings from CPA Australia have unveiled a concerning trend, with only 16% of respondents reporting full clarity about the outcome of their tax return. A significant 37% had a rough idea, while an alarming 22% had no clue at all. This lack of clarity stems from recent changes in tax regulations, causing taxpayers to be taken aback when their expected refunds did not materialize as anticipated.

One of the main factors contributing to taxpayers' uncertainty is the recent overhaul of tax rules, especially regarding work-from-home deductions and the removal of LMITO. These changes might have caught many taxpayers off-guard. For example, the requirement to keep detailed records of work-from-home expenses and other deductions might have been overlooked by some taxpayers, affecting the amount they can claim.

The survey also revealed that taxpayers who engaged in the services of tax agents received substantially better results. The average tax refund for returns processed during July was $2,331, but those using tax agents obtained an average return of $2,669, compared to $2,228 for self-preparers. This discrepancy emphasizes the value of professional tax advice, which can lead to more accurate returns and potentially higher refunds.

To avoid this scenario, it is essential for taxpayers to enhance their tax literacy or seek assistance from tax professionals. Those with additional complexities in their tax situation, such as rental income or crypto currency trades, would especially benefit from expert advice. Tax professionals have in-depth knowledge of the tax laws and can help taxpayers optimize their deductions, ensuring compliance with all regulations.

The annual task of filing taxes need not be daunting or uncertain. By staying informed about recent tax changes and seeking expert guidance when needed, taxpayers can navigate the complexities and maximize their refunds. With the right approach, tax season can become a more manageable and rewarding experience for everyone. This blog has been prepared for the purposes of general information and guidance only. It should not be used for specific advice or used for formulating decisions under any circumstances. If you would like specific advice about your own personal circumstances, please feel free to contact us on 02 9411 5422. We can help make sure the right method is used to give you the maximum possible tax deduction associated with any of these methods.

This blog has been prepared for the purposes of general information and guidance only. It should not be used for specific advice or used for formulating decisions under any circumstances. If you would like specific advice about your own personal circumstances, please feel free to contact us on 02 9411 5422. We can help make sure the right method is used to give you the maximum possible tax deduction associated with any of these methods.