The Future Maintainable Earnings (FME) methodology is the most common method of valuing profitable...

Family Law Business Valuation Methodologies

There are five basic business methodologies used in Family Law matters as detailed in Wilde & Wilde (2007) FamCA 1044 :

- Discounted Cash Flow

- Capitalisation of Future Maintainable Earnings

- Value of Net Tangible Assets ( going concern basis)

- Notional Realisation of Assets

- Capitalisation of Future Maintainable Dividends

The article provides a brief discussion of the various models.

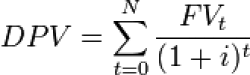

Discounted Cash Flow (DCF)

The discounted cash flow (DCF) value is the present value of the expected future streams of cash flows discounted at a rate which reflects interest rates and the risk associated with the business.

The discounted cash flow methodology is considered as the most accurate business valuation methodology and is the basis for all other income valuation methdologies. The DCF methodology requires projections of the business into the future (10 years) in terms of profitability, balance sheets and cash flows and it also requires a determination of the terminal value of the business at the end of the 10 year period.

One of the problems in applying a discounted cash flow to businesses in the Family Law environment is that the required information is rarely available in terms of reliable long term budgets and cash flow requirements and as such a high level of assumptions is required by the valuer that may not have sufficient evidence to support.

Capitalisation of Future Maintainable Earnings (FME)

The Capitalisation of Future Maintainable Earnings (FME) is the most common method used in the valuation of profitable businesses in the Family Law environment. The FME methodology is well understood by the legal profession and uses fewer assumptions that the DCF method. The FME methodology can be proven mathematically to equal the DCF method.

The problems with the FME method is that it can be difficult to apply to high growth companies or those with abnormal capital expenditure requirements. Despite being a commonly used and well known methodology, the methodology is often incorrectly applied, by assuming that the result equals the value of the goodwill rather than the value of the business.

Value of Net Tangible Assets (Going Concern Business) (NTA)

The value of Net Tangible Assets methodology is used were the business continues to be profitable and is likely to continue but where there is no goodwill, because the business does not generate sufficient profits. That is, the capitalised value of the mainatianable assets does not exceed the net tangible business assets employed to generate the those profits.

Notional Realisation of Assets

Notional Realisation of Assets is used where it is likely that the business will not continue into the future. The calculations of value are dependant on the assumptions as to how those assets will be realised - ie: orderly sale, liquidation, or fire sale. It is also used in the valuation of investment companies where the assets such as property and publicly traded shares are held.

Capitalisation of Future Maintainable Dividends

This method is only used in the valuation of minority interests and then only in very limited cirumstances. This methodology assumes that the minority shareholder will have no access to the undistributed retained earnings of the company and that a pattern of dividends has been established in the past.