Ever heard of Director Penalty Notices (DPNs)?

Directors Beware! - Personal Liability for Unpaid PAYG & Super

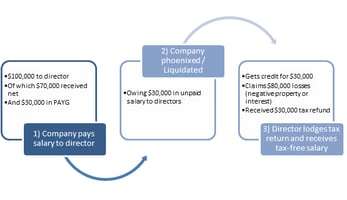

The increasing number of companies going into liquidation and administration has sparked a proposal by the treasury to increase the liability of directors for failing to meet their obligations as employers.

The increasing number of companies going into liquidation and administration has sparked a proposal by the treasury to increase the liability of directors for failing to meet their obligations as employers.

The proposed changes, currently outlined in a draft exposure bill, aims to pierce the corporate veil that directors have used to protect themselves from personal liability in instances where companies fail to meet their obligations.

What does this mean for directors?

The proposed changes to legislation will mean that directors will be personally liable for unpaid PAYG withholding taxes (taxes withheld from salary and wages) as well as unpaid Superannuation. The legislation allows for amounts outstanding to be withheld from the directors own salary, increasing their own tax liability. The personal assets of directors are also susceptible.

Late Lodgement

Directors will also be liable in the instance where superannuation and PAYG amounts have not been declared or lodged. So, failing to report these amounts or even reporting them late does not extinguish liability. The ATO will allow 3 months from the due date to report and pay the required amounts. After this, the directors WILL become liable.

Even if the company goes into liquidation or administration, the directors WILL have to pay all outstanding amounts!

What can directors do?

Directors need to ensure that Business Activity Statements, Taxation Returns and Superannuation Contributions are reported on time and paid on time!

When do these changes commence?

It is likely the proposed changes will be in place by the end of 2011.