Why Australian Married women struggle to go back to the workforce

- Arnold Shields

- May 14, 2020

- 3 min read

Updated: May 21, 2025

When the COVID-19 pandemic eventually became part of our past, it was hoped the federal government would take a serious look at how the personal tax and welfare systems interact, particularly for women with children re-entering the workforce.

If Australia wants to reboot its economy and boost productivity, we need everyone at work. But for many women, especially those in dual-income households—the financial penalties for working more days are simply too high.

The Tax Trap for Second Income Earners

In most families, one partner (often the woman) becomes the secondary income earner after having children. These second income earners face disproportionately high marginal effective tax rates. This refers to the percentage of each additional dollar earned that’s lost to:

Higher income tax

Reduced family tax benefits

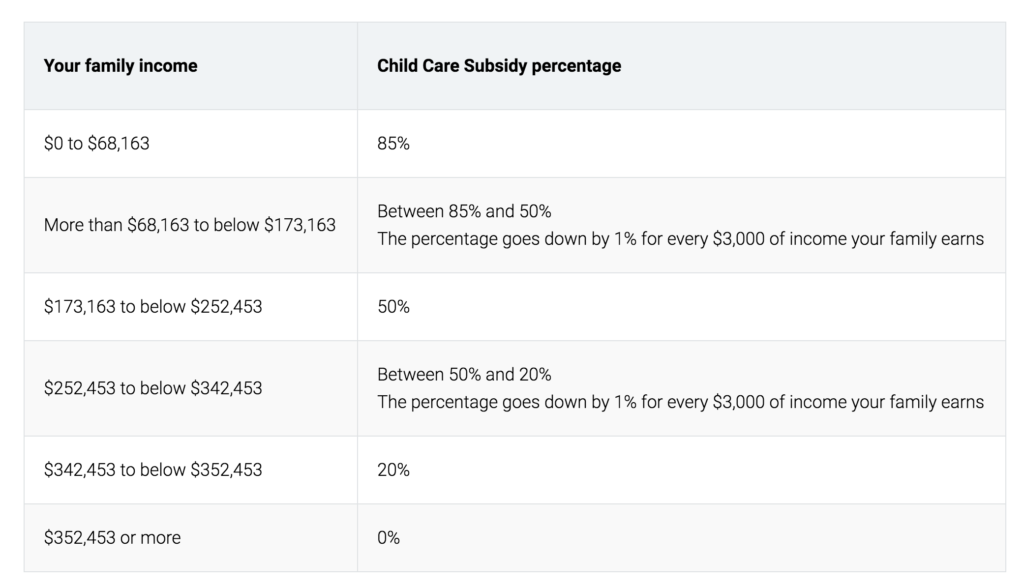

Loss of childcare subsidies

In some cases, the effective marginal tax rate can be 70% or more. That’s before even considering the out-of-pocket cost of childcare.

Childcare Costs That Make Work Not Worth It

Childcare in Australia is far from affordable. The average daily cost is $106.39 per child, before any subsidies. In wealthier suburbs like Mosman, it’s not uncommon to pay up to $200 per day. For a mother with two young children, increasing her work week from three to four days can leave her financially worse off due to these combined costs.

This disincentive structure means many capable, educated women are staying home—not because they want to, but because the system makes returning to work uneconomical.

The Numbers Don’t Lie

A report examining 125,000 partnered women with children across various income brackets found that nearly all were worse off by increasing their work hours due to this interaction between tax, benefits, and childcare subsidies.

These findings are a wake-up call for policymakers.

What Needs to Change?

To support women, and men, in returning to work, especially after career breaks due to caregiving, we need:

A more equitable tax system for second income earners

Affordable and accessible childcare

Reforms to Family Tax Benefit and Child Care Subsidy structures

Incentives that reward work, not punish it

Example:

If a young couple with two young children in long day care earned a minimum wage rate of $37,500.

The family is only $900 a year better off.

This is due to the fact that a family loses 88% of their extra $7500 in income when the mother increases her working days from 3 – 4 per week. So on the extra day, the most is working for just $2.50 an hour.

Example :

If the father earns $80,000 a year, and the mother half of that, then she would be working for less than $1 an hour on her fourth working day.

In a 2018 report, suggested that if the gap between Australia’s male and female workforce participation rates could be halved, annual GDP would be $60 billion greater in 2038.

I think it’s important to help women or 2nd income earners go back to the workforce, as an overall view it’s better for the growth of the economy and its better for women not to be victims of the tax system and be able to utilise their skillset in the best way possible.

Final Thoughts

We can't afford to have half the workforce sitting on the bench. The current system punishes effort and productivity from secondary earners in families. If the government is serious about economic recovery and gender equity, a major tax and welfare system review must be on the agenda.

At Dolman Bateman, we’re committed to helping individuals and families understand how tax impacts real life, and advocating for smarter policies that work for all Australians.

Disclaimer:

The information provided in this article is general in nature and does not constitute personal financial, legal or tax advice. While every effort has been made to ensure the accuracy of this content at the time of publication, tax laws and regulations may change, and individual circumstances vary. Dolman Bateman accepts no responsibility or liability for any loss or damage incurred as a result of acting on or relying upon any of the information contained herein. You should seek professional advice tailored to your specific situation before making any financial or tax decision.